全國(guó)統(tǒng)一客服:400-609-3963

濟(jì)南代理記賬公司教你一分鐘理解什么東西最值得出資?

Jinan bookkeeping agency company will teach you one minute to understand what most worthy of investment?

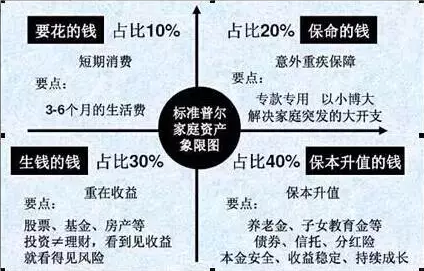

一、財(cái)富的4321規(guī)律

A 4321 law, wealth

即產(chǎn)業(yè)的合理裝備的比例是,家庭總收入的五分之二用于房貸等長(zhǎng)時(shí)刻固定財(cái)物的出資;30%用于家庭平時(shí)日子開(kāi)支;五分之一用于靈活的銀行存款以備應(yīng)急之需;剩余的少部分用于穩(wěn)妥確保或許危險(xiǎn)系數(shù)與收益系數(shù)都比較高的股票、期貨出資。濟(jì)南代理記賬公司

The proportion of the industry of reasonable equipment is that two 5 of the total household income used for mortgage isometric point fixed property of capital contribution; 30% for family day spending at ordinary times; One 5 for flexible bank deposit will be needed in case of emergency; The remaining few for safe ensure that perhaps the benefits and risk coefficient is relatively high stock, futures investment. Jinan bookkeeping agency company

二、財(cái)富的72規(guī)律

Second, the 72 law of wealth

出資理財(cái)所取得的收益,通常不取出,而持續(xù)投入理財(cái)本金,完成利滾利的高收益財(cái),本金增值一倍所需求的時(shí)刻等于72除以年收益率。假如在銀行存款1萬(wàn)元,年利率是2%,那末通過(guò)多少年才干增值為2萬(wàn)元?只要用72除以2得36,便可大約知道銀行存款需36年才干翻番。

Investment financing of earnings, usually do not take out, while continuing to pour money into financial principal, complete arbitrage higher-yielding wealth, capital gains double demand by the moment is equal to 72 divided by yield. If in the bank deposit 10000 yuan, annual interest rate is 2%, then by how many talent value for RMB 20000 per year? With 72 divided by 2 is 36, bank deposits, can know about 36 years double abilities.

三、出資的關(guān)鍵:對(duì)身體健康的出資

Three, paid the key: funding for health

即便你所出資的項(xiàng)目有100%的收益每一年,但卻健康狀況很差,那出資賺再多的財(cái)富又有什么用呢。對(duì)身體健康的出資堅(jiān)持有健康的身體是人生的根基,而健康是生命的基本確保和尋求人生抱負(fù)的條件條件,是最大的財(cái)富。有健康,才有生命的確保,才干完成財(cái)富的含義。正所謂沒(méi)有健康就沒(méi)有全部。也正如中國(guó)已故的著名醫(yī)學(xué)專家馮理達(dá)說(shuō)的那樣“健康是1,工作、財(cái)富、婚姻、名利等等都是后邊的0,由1和0能夠構(gòu)成10、100等N種不一樣巨細(xì)的值,假如沒(méi)有健康這個(gè)1,別的條件再多也只是0。”

Even if you paid by the project has 100% of its revenue each year, but it is in poor health, it is contributive to earn more wealth and what use? Funding for health insist to have a healthy body is the foundation of life, and health is the basic to ensure life and seeking conditions, the conditions of ambition in life is the biggest wealth. To have healthy, to have life to ensure, ability to complete the meaning of wealth. Is the so-called no health, no all of them. As the late famous Chinese medicine experts Feng Lida said "health is 1, the work, wealth, marriage, fame and wealth, and so on are all behind 0, made up of 1 and 0 to 10, 100 different N kind of intrusive value, if this 1 without health, other conditions is only 0."

四、出資要有高遠(yuǎn)的戰(zhàn)略眼光

Four, is contributive to have lofty strategic vision

短線出資目光不能短視,長(zhǎng)線出資也要有辯證的開(kāi)展眼光,今日的朝陽(yáng)工業(yè)或許明天會(huì)變?yōu)槁淙展I(yè)。挑選好的出資,小錢會(huì)生大錢。反之,則可能會(huì)像“肉包子打狗,有去無(wú)回”。金錢在于運(yùn)動(dòng):金錢的實(shí)質(zhì)在于活動(dòng),錢是不能休眠的。當(dāng)今經(jīng)濟(jì)社會(huì)開(kāi)展一日千里,資金只能在出資流轉(zhuǎn)中才干不斷完成保值和增值。出資失誤是丟失,資金阻滯不動(dòng)也是丟失。

Eye not myopic investment in short term, long term investment also should have the dialectical development view, today's sunrise industry maybe tomorrow will be into the sunset. Choose good pay, money will have a lot of money. On the other hand, may be like "meat dumplings dozen dog, have go no return". Money is the movement: money is the essence of the activity, money is can't sleep. In the modern business world in a day, the money can only be paid circulation of talent in the complete value maintained and added constantly. Venture capital for the error is lost block is missing.

五、出資組合

Five, the investment portfolio

思考到家庭財(cái)物的狀況,危險(xiǎn)程度,時(shí)刻出資期限,變現(xiàn)才能,出資靈活性,都要進(jìn)行歸納思考,確保在家庭有緊迫需求時(shí)能立刻變換出需求的資金。危險(xiǎn)忍耐度原則即"日子危險(xiǎn)忍耐度",確保本金是出資理財(cái)?shù)闹刂兄兀砍鲑Y都需求恪守此規(guī)矩。

Thinking to the status of the family property, dangerous degree, time investment period, cash ability, investment flexibility, inductive thinking to ensure that there is urgent demand in the family can immediately transform the money demand. Dangerous patience principle namely "dangerous days patience", to ensure that the principal is the key of the investment finance, capital needs to stick to this rule.

六、理財(cái)?shù)膸讉€(gè)小技藝

Six, a few small art of finance

首要,理財(cái)?shù)臈l件有必要是要有人必定的財(cái)可理,并且應(yīng)當(dāng)有定時(shí)的安穩(wěn)收入源,否則,無(wú)基本之財(cái)怎么理。

First, finance condition is necessary is to someone must have money can, and should have a regular source of steady income, otherwise, no basic money how to manage.

接著,樹(shù)立一個(gè)家庭財(cái)物狀況一覽表,你需求隨時(shí)清楚地把握了解家庭的產(chǎn)業(yè)數(shù)額和財(cái)物性質(zhì),一起也要了解相應(yīng)的產(chǎn)業(yè)法規(guī)。

Then set a schedule to family financial situation and your needs clearly grasp the understanding of family inheritance amount at any time and the characteristics of the property, also want to know the corresponding industry regulations.

其次,理財(cái)需求多樣化理財(cái),理財(cái)所用的本錢要多樣化出資,切不行將很多雞蛋放在一個(gè)籃子里,渙散危險(xiǎn),擴(kuò)寬理財(cái)途徑,添加收益。然后,出資理財(cái)?shù)闹芷陂L(zhǎng)短相結(jié)合,合理安排,做到活動(dòng)性好,避免關(guān)鍵期間有錢而不能運(yùn)用。

Second, finance finance demand diversity, used by financial capital to diversified investment, not cut will be a lot of eggs in one basket, distractions, broaden financing way, add profits. Then, combining the cycle length of the investment finance, reasonable arrangement, do good activity, avoid rich and cannot use during key.

終究,很主要的是,理財(cái)不過(guò)是為是財(cái)富的增值或許保值,有錢的終究意圖是讓日子過(guò)得愈加幸福美滿,衣食無(wú)憂,財(cái)富在恰當(dāng)期間應(yīng)當(dāng)擬定恰當(dāng)?shù)挠?jì)劃用于花費(fèi)。假如只為理財(cái)而理財(cái),那就不沒(méi)有了實(shí)際的含義。

After all, it is mainly that financial management is just as wealth appreciation may be hedging, rich, after all, intention is to make life more happy, comfortable, wealth during the appropriate should develop appropriate plan to spend. If only for financial management and financial management, that is not no practical meaning.

為何得出結(jié)論出資自個(gè)最主要?

Why the conclusion capital contribution from the main?

關(guān)于出資自個(gè)要長(zhǎng)遠(yuǎn)一點(diǎn),從一生的視點(diǎn)來(lái)看,究竟哪些工作是主要的,值得咱們?nèi)コ鲑Y的?

About themselves to the long term, from the perspective of life, what work is the main, is worth us to pay?

假如將日子的各種工作列入四項(xiàng),我覺(jué)得那些值得我出資的必定是主要而不緊急的工作,它們都不是一朝一夕的功夫能夠練就的,而是在三五年,十年二十年以后,方能感恩于當(dāng)初所花費(fèi)的精力和時(shí)刻。最主要的自我出資包含3個(gè)方面:

If the days of work in four, I think that I must be a main but not urgent work, they are not going to kung fu to develop, but in three to five years, ten years after twenty years, can be grateful to the amount of energy and time. The main self funded include three aspects:

1.中心競(jìng)爭(zhēng)力

1. The center competitiveness

在這個(gè)世界上,你的安生立命之本是什么?能夠是你的工作,能夠是你的某項(xiàng)興趣愛(ài)好,可是在這個(gè)方面,你是被不行代替的。特別是關(guān)于絕大多數(shù)上班族來(lái)說(shuō),你的收入,往往與你的不行代替性是成正比的。之前看到一個(gè)有趣的說(shuō)法,很多人上班,只是是為了那每個(gè)月的收入,這其實(shí)是買櫝還珠,你去上班,最根本的應(yīng)當(dāng)是通過(guò)實(shí)習(xí)以及跟別人學(xué)習(xí),所取得的本身實(shí)力的進(jìn)步,這才是你用天天8小時(shí)換來(lái)的最有價(jià)值的東西。濟(jì)南代理記賬公司

In this world, what is the life for your father? Can is your work, is you a hobby, but in this respect, you are no substitute. Particularly with regard to the vast majority of workers, your income, and often you can't replace sex is proportional to the. Before you see an interesting, a lot of people go to work, just for that income per month, this is actually choose the wrong thing, you go to work, the most fundamental should be through practice and learning with others, itself of the progress of power, this is the eight hours a day do you use for the most valuable things. Jinan bookkeeping agency company

2.堅(jiān)持健康

2. Stick to health

一個(gè)人的健康是沒(méi)有代替計(jì)劃的,工作能夠換,錢能夠再掙,可是生命不能夠重頭來(lái)過(guò)。在年青的時(shí)分,咱們都覺(jué)得疾病與逝世都離得很遠(yuǎn)。可是,事實(shí)上,健康的身體必定是從年青時(shí)分開(kāi)端打的基礎(chǔ)。所以我每周都會(huì)做最少3次有氧運(yùn)動(dòng),每次半個(gè)小時(shí)以上。這一起使得我精力充沛,非常好地享受日子。堅(jiān)持健康一起也包含你的日子習(xí)慣,遠(yuǎn)離反式脂肪,街邊小攤。管住嘴,邁開(kāi)腿。

A person's health is not instead of the plan, work to change, the money can be earned again, but life will not be able to start. In young, we all feel illness and death from very far. But, in fact, the healthy body will be from young beginning in fundamentals. So I do aerobic exercise at least 3 times every week, more than half an hour at a time. It makes me energetic together, very good to enjoy life. Sticking to a healthy habit also contains your day together, away from trans fats, street stalls. Tube shut up, took his leg.

3.理財(cái)

3. The financial

我一直跟兄弟強(qiáng)調(diào),理財(cái)是一項(xiàng)技術(shù),是咱們走出校園,面臨社會(huì)日子要學(xué)會(huì)的一項(xiàng)基本的技術(shù)。理財(cái)和工作,是積累財(cái)富的2條腿,相得益彰。

I have been with brother stressed that finance is a technology, is out of our campus, face a basic social life to learn technology. Financial management and work, the accumulation of wealth is 2 legs, bring out the best in each other.

濟(jì)南代理記賬公司:http://www.yinyon.cn/